Galactic Realtors Your Real Estate Consultant

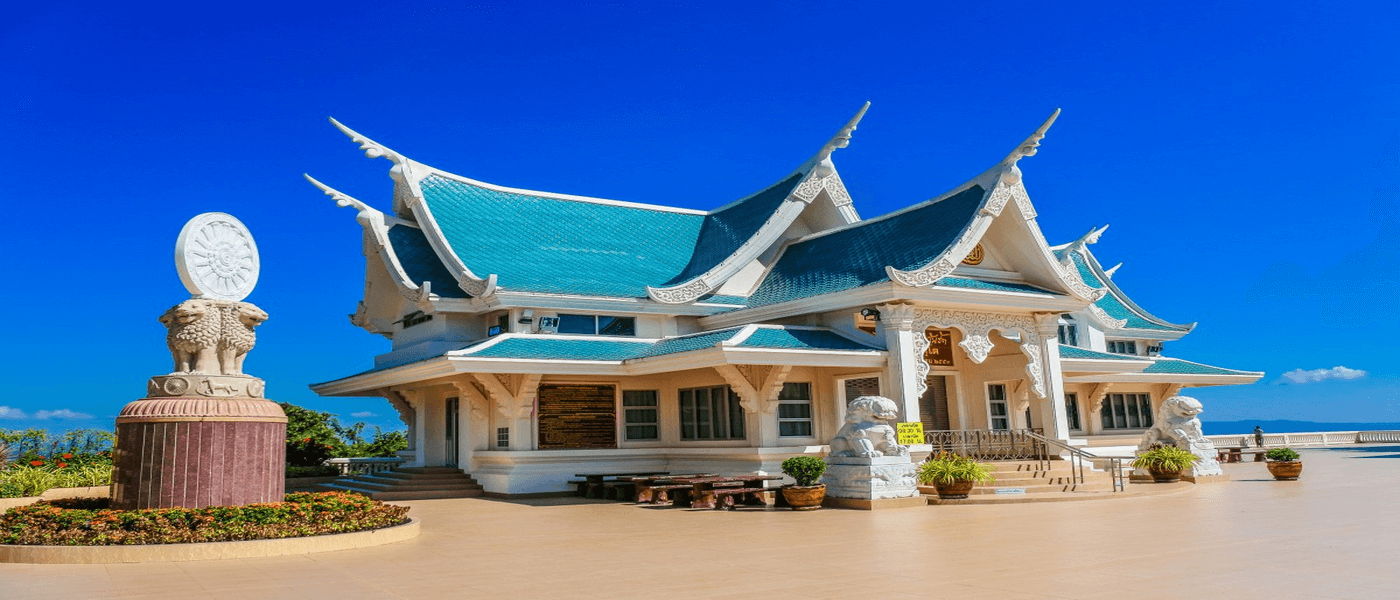

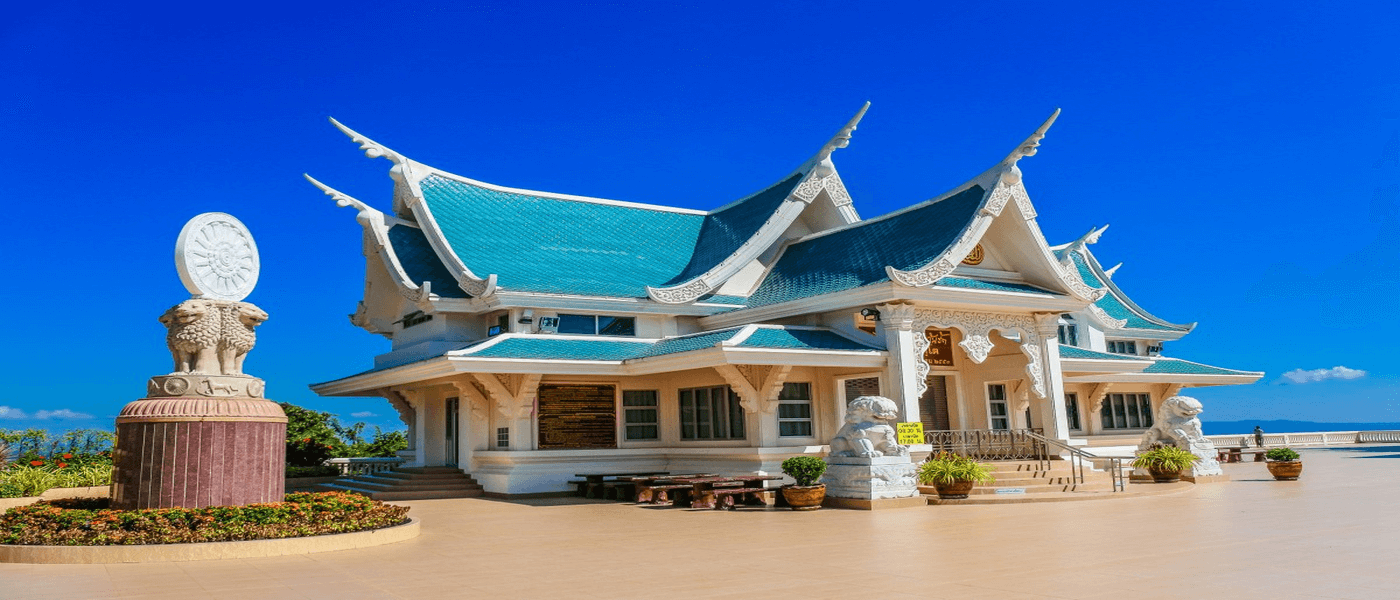

Residential Real Estate ConsultantYour real estate consultant assistance in residential real estate properties may range from single-family houses and condos to townhouses and multi-family buildings. Demand in residential real estate is driven by population growth, interest rates, economic stability, and demographic trends. Quality of schools, job opportunities, and nearness to amenities also turn out as major factors in the value and desirability of residential properties. For homeowners, property buying is not just an investment but also an emotional promise because properties serve as a personal space and family legacy for most.

Commercial real estate consultant

Commercial real estate consultant on the other hand, includes properties used for business purposes, such as office buildings, retail centers, hotels, and restaurants. The commercial real estate market is heavily influenced by the performance of the economy, as demand for office and retail space increases with business growth and consumer spending. Location is paramount in commercial real estate; properties in high-traffic, accessible areas tend to attract more businesses and customers, thereby enhancing property values. Commercial properties can generate income through leasing to businesses, providing consistent revenue streams to investors.

Industrial real estate consultant

Industrial real estate consultant includes warehouses, factories, and distribution centers, which are essential for logistics, manufacturing, and supply chain management. With the rise of e-commerce, industrial real estate has gained importance, especially in strategically located areas near major transportation hubs. The demand for industrial properties has been further driven by the need for storage and efficient distribution facilities, making it a growing sector within the industry.

Real estate investment offers individuals and businesses a way to diversify their portfolios. Investors can purchase properties directly or indirectly through real estate investment trusts (REITs) that provide a way to invest in large-scale real estate portfolios. REITs offer a more accessible entry into real estate investment, allowing people to invest in diverse property types with lower capital requirements than direct ownership. Investors in real estate seek benefits such as appreciation, cash flow from rental income, and tax advantages

Market trends in real estate are impacted by numerous external factors, including interest rates, government policies, and social shifts like remote work. For example, low-interest rates can spur demand by making mortgages more affordable, while high-interest rates may dampen buying activity. Similarly, the increase in remote work options has influenced residential real estate, as people prioritize homes with office space or seek properties in suburban and rural areas for more space and affordability.

In conclusion, real estate is a dynamic and multifaceted industry. It requires knowledge of market trends, economic factors, and property values. Whether for personal use, business operations, or investment, real estate plays a central role in shaping where people live, work, and build their futures. With careful planning and strategic investment, real estate offers opportunities for financial growth and stability